- Energy Code Assistance

- Energy Code Facts

- IECC Blower Door Test

- Illinois Blower Door Test Results

- Addison Blower Door Test Results | Air Leakage Testing | Energy Code Testing

- Antioch Blower Door Test Results | Air Leakage Testing | Energy Code Testing

- Arlington Heights, IL Blower Door Test Results I IECC Code Verification

- Barrington Blower Door Test Results | Air Leakage Testing | Energy Code Testing

- Barrington Hills Blower Door Test Results I Illinois Energy Code Tests

- Beach Park Blower Door Test Results | Air Leakage Testing | Energy Code Testing

- Bloomingdale Blower Door Test Results | Air Leakage Testing | Energy Code Testing

- Brookfield Blower Door Test Results | Air Leakage Testing | Energy Code Testing

- Chicago Blower Door Tests | Illinois Energy Code Testing

- Clarendon Hills Blower Door Tests | Clarendon Hills Energy Conservation Code Testing

- Deerfield, IL Blower Door Tests I IECC Verification

- Desplaines Blower Door Tests | Air Leakage Testing | Energy Code Testing

- Downers Grove Blower Door Test Results I Illinois Energy Code Tests

- Elk Grove Blower Door Test Results | Air Leakage Testing | Energy Code Testing

- Elmhurst Blower Door Test

- Glen Ellyn Blower Door Tests | Air Leakage Tests | Illinois Energy Code Testing

- Glencoe, IL Blower Door Tests I IECC Code Compliance

- Glenview Blower Door Test Results | Air Leakage Testing

- Highland Park Blower Door Test Results | Air Leakage Testing | Energy Code Testing

- Hinsdale Blower Door Test Results

- Kenilworth Blower Door Test Results | Air Leakage Testing | Energy Code Testing

- Lake Forest Blower Door Test Results | Air Leakage Testing | Energy Code Testing

- Lake Zurich Blower Door Test Results | Air Leakage Testing | Energy Code Testing

- Lombard Blower Door Testing | Air Leakage Testing Results

- Mount Prospect Blower Door Test Results | Air Leakage Testing | Energy Code Testing

- Naperville Blower Door Test | Illinois Energy Code Testing

- Niles Blower Door Tests | Illinois Energy Code | Air Tightness Testing

- Northbrook Blower Door Test Results | Air Leakage Test

- Oak Brook Blower Door Test Results | Air Leakage Testing | Energy Code Testing

- Palatine Blower Door Test Results | Air Leakage Testing | Energy Code Testing

- Park Ridge Blower Door Test | Illinois Energy Code | Air Tightness Testing

- Skokie, IL Blower Door Tests I IECC Verification

- Vernon Hills Blower Door Test Results | Air Leakage Testing | Energy Code Testing

- Western Springs Blower Door Test Results | Air Leakage Testing | Energy Code Testing

- Wilmette Blower Door Tests | Air Leakage Testing | Illinois Energy Code Testing

- Winnetka Blower Door Results | Air Leakage Testing | Illinois Energy Conservation Code

- Illinois Blower Door Test Results

- IECC Duct Testing

- IECC Energy Modeling

- Energy Code Comparison Charts

- Indoor Air Quality

- Energy Efficiency

- Aeroseal

- Facts & Benefits of Duct Sealing

- Aeroseal for New Construction & Code Compliance

- Aeroseal for Commercial Buildings

- Aeroseal for Existing Homes

- Aeroseal Service Territory | Illinois Leading Aeroseal Dealer

- Addison Aeroseal | Illinois Duct Sealing | Duct Testing

- Arlington Heights Aeroseal | Illinois Duct Sealing | Duct Test

- Barrington Aeroseal | Illinois Duct Sealing | Duct Testing

- Brookfield Aeroseal | Illinois Duct Sealing | Duct Testing

- Chicago Aeroseal | Illinois Duct Sealing | Duct Test

- Clarendon Hills Aeroseal | Illinois Duct Sealing | Duct Testing

- Cook County Aeroseal | Illinois Duct Sealing | Duct Testing

- Deerfield Aeroseal | Illinois Duct Sealing | Duct Tests

- Des Plaines Aeroseal | Illinois Duct Sealing | Duct Testing

- Downers Grove Aeroseal | Illinois Duct Sealing | Duct Testing

- Dupage County Aeroseal | Illinois Duct Sealing | Duct Testing

- Elk Grove Village Aeroseal | Illinois Duct Sealing | Duct Test

- Elmhurst Aeroseal | Illinois Duct Sealing | Duct Tests

- Evanston Aeroseal | Illinois Duct Sealing | Duct Testing

- Glen Ellyn Aeroseal | Illinois Duct Sealing | Duct Testing

- Glenview Aeroseal | Illinois Duct Sealing | Duct Sealing & Testing

- Highland Park Aeroseal | Illinois Duct Sealing | Duct Tests

- Hinsdale Aeroseal | Illinois Duct Sealing | Duct Testing

- Kenilworth Aeroseal | Illinois Duct Sealing | Duct Testing

- Lake County Aeroseal | Illinois Duct Sealing | Duct Testing

- Lake Forest Aeroseal | Illinois Duct Sealing | Duct Testing

- Lake Zurich Aeroseal | Illinois Duct Sealing | Duct Testing

- Lombard Aeroseal | Illinois Duct Sealing | Duct Testing

- Mt. Prospect Aeroseal | Illinois Duct Sealing | Duct Testing

- Naperville Aeroseal | Illinois Duct Sealing | Duct System Testing & Sealing

- Niles Aeroseal | Illinois Duct Sealing | Duct Leakage Testing

- Northbrook Aeroseal | Illinois Duct Sealing | Duct Testing

- Northfield Aeroseal | Illinois Duct Sealing | Duct Testing

- Oakbrook Aeroseal | Illinois Duct Sealing | Duct Testing

- Oakpark Aeroseal | Illinois Duct Sealing | Duct Testing

- Orland Park Aeroseal | Illinois Duct Sealing | Duct Testing

- Palatine Aeroseal | Illinois Duct Sealing | Duct Tests

- Park Ridge Aeroseal | Illinois Duct Sealing | Duct Tests

- Schaumburg Aeroseal | Illinois Duct Sealing | Duct Tests

- Vernon Hills Aeroseal | Illinois Duct Sealing | Duct Testing

- Western Springs Aeroseal | Illinois Duct Sealing | Duct Testing

- Wilmette Aeroseal | Illinois Duct Sealing| Duct Sealing & Testing

- Winnetka Aeroseal | Illinois Duct Sealing | Duct Testing

- The Cost of Duct Leakage

- HVAC Design & Testing

- HVAC Residential Design, Test & Balance

- HVAC Commercial Design, Test & Balance

- Ventilation Systems Defined

- Commercial Client List

- HVAC Sizing Territory | Mechanical Sizing | Test and Balance

- Addison Test & Balance | Mechanical Sizing | ACCA Manual J

- Arlington Heights Test & Balance | Mechanical Design | ACCA Manual J

- Barrington IL Test & Balance | Mechanical Sizing | ACCA Manual J

- Brookfield Test and Balance | Mechanical Sizing | ACCA Manual J

- Chicago Test & Balance | Mechanical Design | ACCA Manual J

- Claredon Hills Mechanical Sizing | ACCA Manual J Loads | Test and Balance

- Cook County Mechanical Sizing | ACCA Manual J Loads | Test and Balance

- Deerfield Mechanical Sizing | ACCA Manual J Loads | Test and Balance

- Des Plaines Mechanical Sizing | ACCA Manual J Loads | Test and Balance

- Downers Grove Mechanical Sizing | ACCA Manual J Loads | Test and Balance

- Dupage County Mechanical Sizing | ACCA Manual J Loads | Test and Balance

- Elk Grove Village Mechanical Sizing | ACCA Manual J Loads | Test and Balance

- Elmhurst Mechanical Sizing | ACCA Manual J Load Calcs | Test and Balance

- Evanston Mechanical Sizing | ACCA Manual J Loads | Test and Balance

- Glen Ellyn Mechanical Sizing | ACCA Manual J Loads | Test and Balance

- Glenview Mechanical Sizing | ACCA Manual J Loads | Test and Balance

- Highland Park Mechanical Sizing | ACCA Manual J Loads | Test and Balance

- Hinsdale Mechanical Sizing | ACCA Manual J Loads | Test and Balance

- Kenilworth Mechanical Sizing | ACCA Manual J Loads | Test and Balance

- Lake County Mechanical Sizing | ACCA Manual J Loads | Test and Balance

- Lake Forest IL Test & Balance | Mechanical Sizing | ACCA Manual J

- Lake Zurich Test & Balance | Mechanical Sizing | ACCA Manual J

- Lombard Test & Balance | Mechanical Sizing | ACCA Manual J

- Mount Prospect Test & Balance | Mechanical Sizing | ACCA Manual J

- Naperville Test & Balance | Mechanical Sizing | ACCA Manual J

- Niles Test & Balance | Mechanical Sizing | ACCA Manual J

- Northbrook Test & Balance | Mechanical Sizing | ACCA Manual J

- Northfield Test & Balance | Mechanical Sizing | ACCA Manual J

- Oakbrook Test & Balance | Mechanical Sizing | ACCA Manual J

- Oakpark Test & Balance | Mechanical Sizing | ACCA Manual J

- Orland Park Test & Balance | Mechanical Sizing | ACCA Manual J

- Palatine Test & Balance | Mechanical Sizing | ACCA Manual J

- Park Ridge Mechanical Sizing | ACCA Manual J Load Calcs | Test and Balance

- Schaumburg Test & Balance | Mechanical Sizing | ACCA Manual J

- Building Science Training

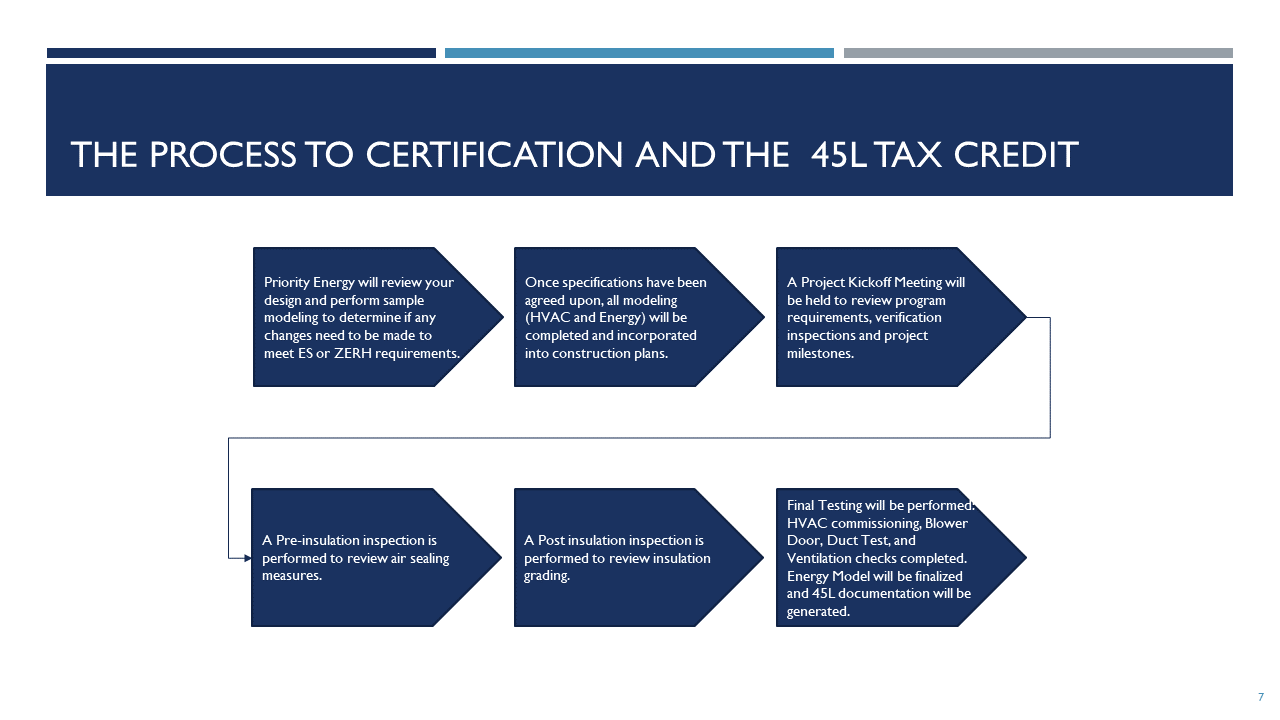

Priority Energy’s HERS Raters have been helping builders qualify for the 45L Energy Efficiency Tax Credit for years. From reviewing designs and modeling energy efficiency trade-offs, to verifying construction details and final testing, their process will ensure your project meets the updated 2023-2024 program requirements and you have the documents required for federal tax filing.

A builder may claim a tax credit for a new construction home with one of the following DOE certifications: ENERGY STAR 3.1, ENERGY STAR 3.2, ENERGY STAR Multifamily 1.1, or DOE ZERH.

The Inflation Reduction Act (IRA)

The 45L tax credit was introduced as an incentive to encourage the construction of energy efficient new homes to be built to exceed the base energy code. If a home were built to use 50% of the heating, cooling and hot water energy of a home built to the 2006 Energy Code standard, it would be eligible to receive a tax credit of $2,000/home or dwelling unit.

The Biden Administration's Inflation Reduction Act (IRA) extended the program through 2032 and updated the energy efficiency requirements. Beginning in 2023 new single family and multifamily homes must be Energy Star or Zero Energy Ready Home-certified to qualify for the tax credit. Since the updated program has gotten stricter, the tax incentive dollars have also increased.

The 45L Federal Tax Credit Incentives - Updated Requirements

The 2023 Tax Credit Process for Builders

Who is Eligible to File for the 45L Tax Credit?

The person who constructed the qualified energy efficient single family home, multifamily building, or produced a qualified energy efficient home that is a manufactured home may file for the 45L Tax Credit. A person must own and have a basis in the qualified energy efficient home during its construction to qualify as an eligible contractor. For example, if the person that hires a third party contractor to construct the home owns and has the basis in the home during construction, the person that hires the third party contractor is the eligible contractor and the third party contractor is not an eligible contractor.

The property owner will complete the IRS Form 8908 and submit energy efficiency verification documents obtained from the Certified HERs Rater that inspected the property throughout construction.

Eligible Recipients may include:

- Single family home builder or developer

- Multi-family home builder or developer

- Manufactured home producer

What Types of Dwellings are Eligible for the Tax Incentive Program?

- New Single Family Homes

- Substantial Reconstruction or Rehabilitation Home Projects

- Affordable Housing (LIHTC)

- Apartment Buildings

- Assisted Living Housing

- Production Home Developments

- Residential Condominiums

- Student Housing